-

A unique opportunity to invest in a Venture Capital focused on Art.

-

The art market is a global and scalable business largely.

-

Regulated VC and in the process of obtaining the European passport.

Wealthy people invest 15% of their overall investments in art,

why don't professional investors do it when they know art is a safe investment?

- Investors need to invest a lot of money to diversify in blue-chip artists

- They know neither costs nor art valuations and are missing opportunities

- Lack of expertise in family offices, institutional and investment firms

- Unregulated nature of the art market

- Unclear valuation for knowing the evolution of art investments

Make blue-chip art funds accessible to accredited investors by the regulated firm. Blue-chip art provided 32.8% yearly yields between 2000 and 2021.

- Diversify by co-investing

- Big data and owned algorithm

- 85 years of accumulated art advisory experience

- Regulated and audited VC and funds

- Updated NAV quarterly and art indexes comparable to financial ones

The art market is an untapped opportunity as indicated by the following indicators:

- The global asset management market is $103T while the alternative asset market is $15T and art funds are just $1B.

- The global market in public auctions is around $65B while the total (including private sales) is $1.6T, of which 70% represents the blue-chip art market (our focus).

- The total art market growth forecast is $2.7T in 2026 with a CAGR of 2.7% per year. This data does not include NFTs or digital art.

Right now is an excellent time to invest in art because is demonstrated by the following data:

- Art performs best in periods of high inflation: art outperformed even gold between 1973 and 1981.

- The performance of the world's 50 blue-chip artists outperformed the Dow Jones index during the financial crisis.

- Low correlation with financial assets that allow for diversification of the investment.

Our target market for the sale of artworks is aimed at wealthy people (over 5M$ of assets) that their number increased by 10% in 2019 globally and a growth of 50% is expected in 2026 thanks to the implosion of the Asian market (China, India, Indonesia).

The accumulated experience of +95 years of our art advisors allows us to demonstrate the validation of obtaining returns in the purchase/sale of blue-chip artists: our advisors managed 45 works of art worth €146 million in the last 5 years which have offered an annual return of 14.52% for 25 artists such as Kandinski, Basquiat, Picasso, Monet, Matisse, Warhol, Calder, Lichtenstein, and Dalí, among others.

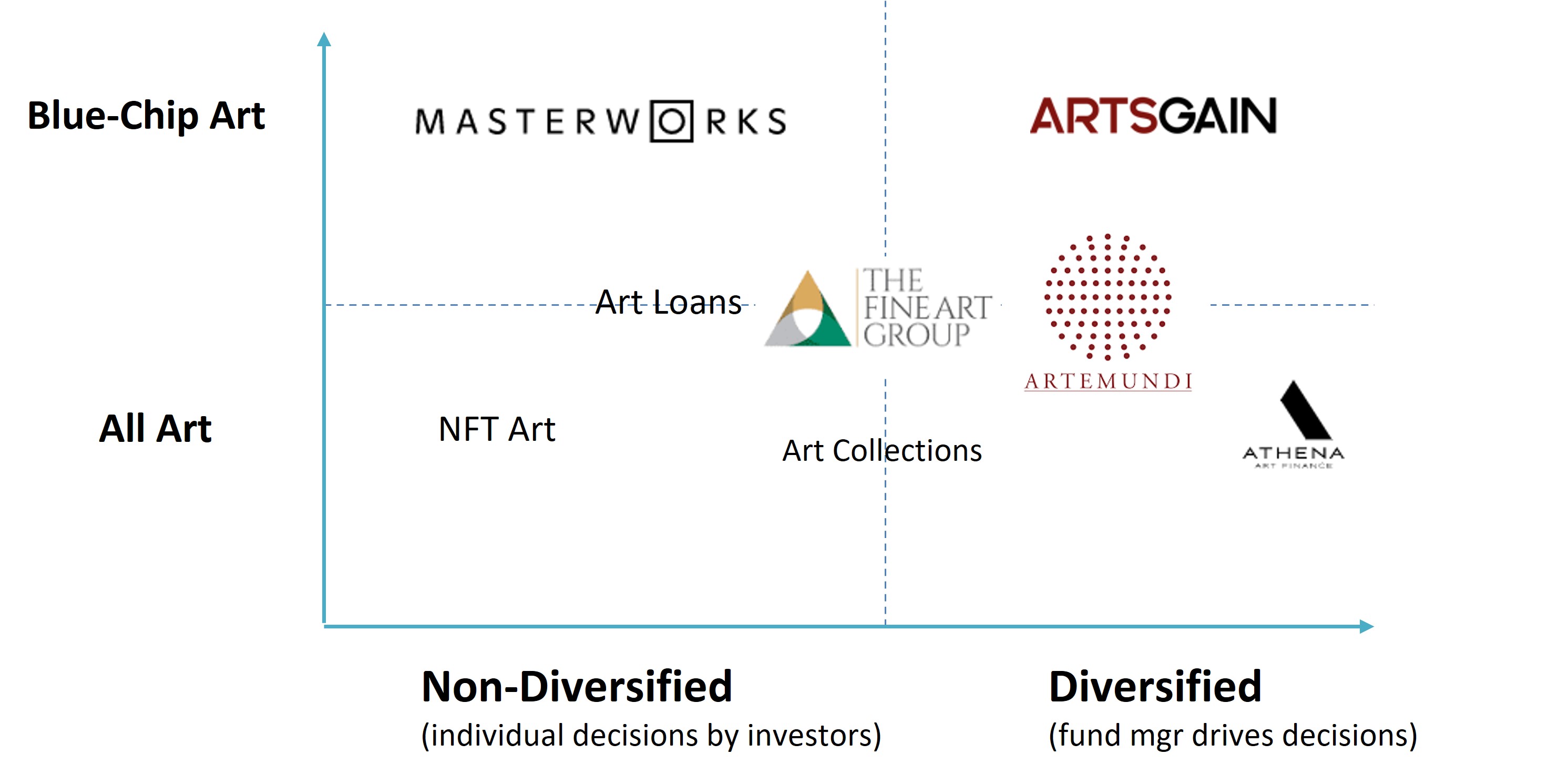

The competitive view is based on how diversified is the portfolio driven by the Asset Mgrs and the type of artists embedded in their art offering (art funds and/or art loans) by the main players as shown in the following graph:

The business model is based on the typical management compensation of Venture Capital firms, which is based on the following income model:

- 2% annual management fee.

- 20% success fee achieved by the investment funds (above 5% as 'hurdle rate').

- Additionally, a 20% commission on loans of the artworks to museums and on gift products and the collection of NFTs created ad-hoc from the acquired works of art.

|

In €uros |

2022 |

2023 |

2024 |

|

Managed Funds (AUM) |

€ 10 M |

€ 69 M |

€ 164 M |

|

Revenue |

€ 69 K |

€ 678 K |

€2.2 M |

|

Expenses |

€ 178 K |

€ 384 K |

€ 649 K |

|

EBIT |

€ -109 K |

€ 293 K |

€ 1.57 M |

|

Revenue/AUM |

0.69% |

0.98% |

1.35% |

|

Expenses/AUM |

1.78% |

0.55% |

0.39% |

Hemos creado un equipo internacional que cubre las regiones del mercado del arte más importantes de gran experiencia y multidisciplinar para ofrecer un valor diferencial a las inversiones tradicionales de inversión.

Team members

Xavier Olivella

CEO

- Certificate in ‘Art Investments’ by Sotheby’s Institute of Arts

- Former Director of the Equity Crowdfunding Association in Spain

I grew up at HP learning Sales, Go-to-Market, Distribution Channels, Marketing, Business Development, Software, and Services. I created my own sales consulting company and telesales group.

I formed 4 startups. I presented the first TEDx in Spain on Architecture.

I have written a book about the experiences of a relative in the civil war.

With two children in their twenties.

The Board of Directors is composed by

- Xavier Olivella: CEO & Co-founder, based in Barcelona

- Ilaria Cavazzana: Art Advisory Director, Seville - Verona

- Advising Private Collectors and Art Funds

- Specialist in Modern and Contemporary Art

- Certificate in 'Art Market' by Sotheby's Institute of Art

- Master in Contemporary Art and Bachelor in Art Wealth Management

- Ernest Sales: Investor, and Counselor, Dubai

- Founder MOI Family Office

- CEO of the biggest Apple Distribuidor in Middle-East and Spain

- Executive Advisor of Grupo Midis Group

- Alfonso Olive: CFO and Legal Advisor, Barcelona

- Specialist in Legal and Financial

- Bachelor in Law

The Advisory team is composed by

- Argimiro Arratia: Fintech Advisor, Barcelona

- Barcelona Tech professor in Computational Finance

- Master in Computer Science, Wisconsin Univ.

- Stefan Piekarski: Art Advisor, Düsseldorf

- Advisor for private collectors and public entities

- Bachelor in Finance, Duisburg-Essen Univ.

- Gabrielle Segal: Art Advisor and Appraisal, New York

- Bachelor in History of Art, Hunter College NYC

- Master Contemporary Art by Sotheby's Institute of Art

- Miguel Hernandez: Art Advisor, Miami

- Art collector and advisor for private collectors and museums

- Curator of Pop, Modern, and Contemporary Art, and Events

- Bastian Wagner: Investment Mgr, London

- Specialist in alternative investments in Eaton Vance, Old Mutual Group, BNY Mellon

- Bachelor in Finance and Certified by Sotheby's Institute of Art

- Premala Matthen: NFT Art Advisor, London

- Former advisor for British Art Fund and JP Morgan

- Certified Sotheby's for Art Contemporary

- Bachelor in Sciences and Economy

Article about the first art fund lunch.

Article about investing in arts.

Webinar jointly with Spanish Association about investing in art funds targetting financial advisors.

Radio interview with the founders.

Interview with CEO about the future of finance related to arts market: tokenisation and NFTs.

Webinar about Investing in Arts.

PR article

TV Webinar about investing in arts.

Investment proposal

Investment proposal summary:

We offer you a unique opportunity to invest directly in a regulated VC for Equity Art Funds.

ArtsGain manages art funds which is an untapped opportunity as a financial asset is considered a store of value with a large capacity to scale globally.

Precisely in these times of big uncertainty, it allows long-term and anti-inflationary revaluations if you invest in the great world artists (blue-chip art) as shown by the economic indicators of the past (1973-2012) and present (during the pandemic times).

Detailed explanation:

A capital increase of €208,000 is offered for 10% of the company's share capital.

The allocation of the invested capital will be used to cover the regulator's capital requirements and financial growth for marketing activities, the distribution channel, and the incorporation of a salesperson from the financial sector.

Lock-up period of 6 months for your investment.

Min. investment: € 1,005 in multiple of € 15 (price per share).